MIRA is an AI mortgage assistant designed to transform how consumers, loan officers, and financial institutions approach mortgage applications. By integrating advanced AI algorithms, MIRA simplifies complex tasks like eligibility analysis, loan comparisons, and pre-approvals, ensuring a seamless, user-friendly experience. This case study highlights the user-centered design approach behind MIRA, showing how AI can reshape the mortgage industry.

IDEA

Simplifying the mortgage process for all involved Personalized loan options, delivered efficiently

The idea behind MIRA was to simplify the mortgage process for all involved —borrowers, loan officers, and institutions. The mortgage journey can be stressful due to the paperwork, eligibility criteria, and loan options that vary significantly for each user. MIRA’s AI solutions were designed to streamline these processes, automate data input, and present users with personalized loan options in a more transparent and efficient manner.

Challenges

The traditional mortgage process is often lengthy, confusing, and frustrating for users, especially first-time homebuyers. Loan officers, on the other hand, face challenges in managing multiple clients, evaluating eligibility manually, and customizing loan offers. The challenge was to create a streamlined, user-friendly platform that serves the needs of both borrowers and lenders.

Research

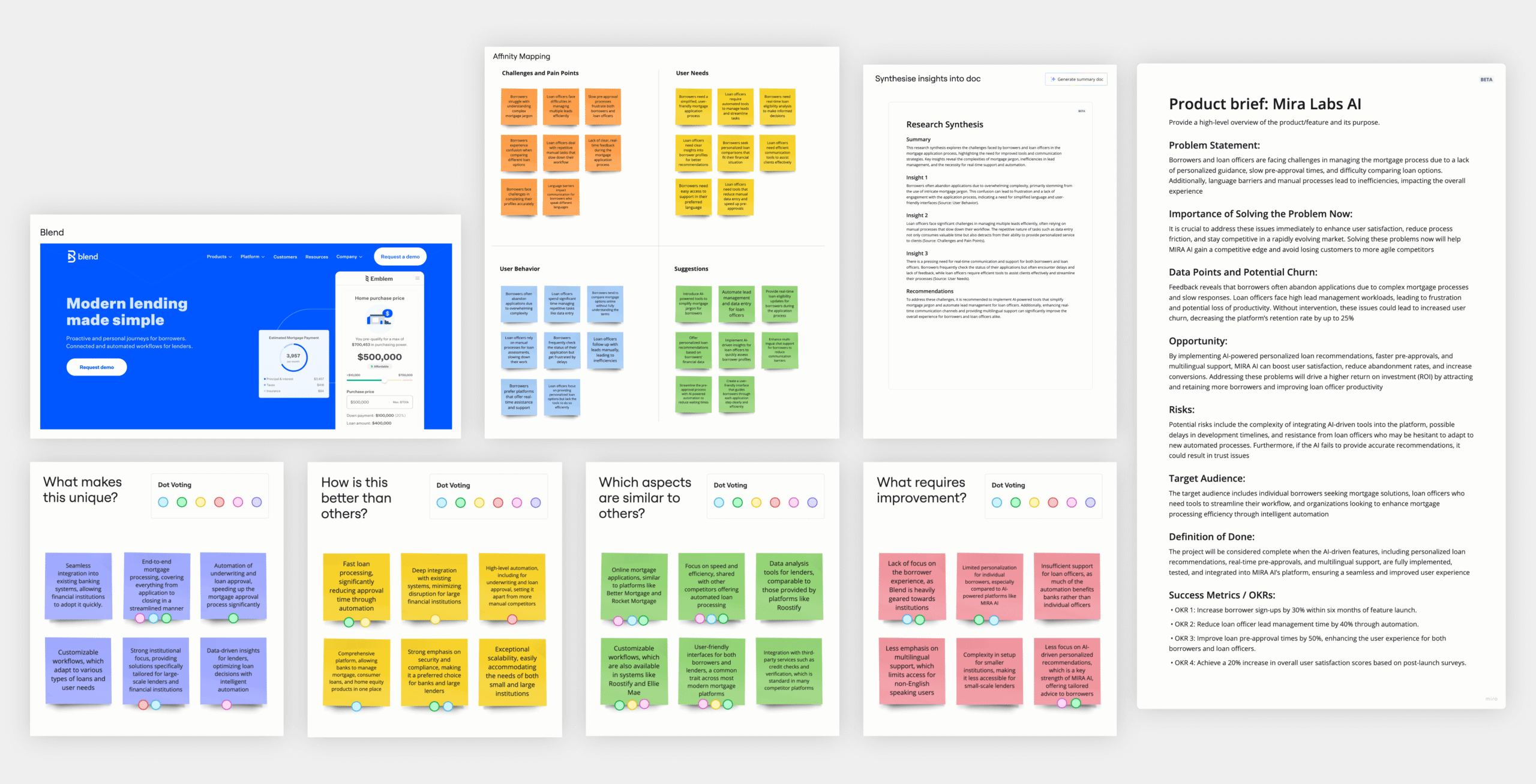

To address the challenges faced by MIRA AI in user engagement and adoption, my team and I conducted extensive research that included user interviews, surveys, and competitive analysis.

User Survey

We surveyed 12 potential borrowers and loan officers to evaluate the platform’s user-friendliness and identify pain points for a diverse user base

User Interviews

We interviewed 6 first-time homebuyers and 4 loan officers to gain insights into their frustrations and usability challenges when navigating the mortgage application process

Competitive Analysis

We performed a competitive analysis of similar mortgage platforms, identifying improvement opportunities and gathering valuable insights to enhance MIRA AI’s features and user experience

KEY FINDINGS

87%

of borrowers found it difficult to understand their eligibility for different mortgage plans

73%

of loan officers expressed frustration with the manual evaluation process, which consumed too much time

64%

of users stated they were overwhelmed by the loan comparison process and had trouble selecting the best option

KEY METRICS

30%

Expected reduction due to AI-powered automation

25%

Targeting an increase through improved UX and guided assistance

20%

Increased lead conversion for loan officers through better management and automation

Insights – Based on research

User research revealed that borrowers were often unsure about their eligibility and overwhelmed by loan comparisons. Loan officers struggled with lead management and time-consuming manual evaluations. These insights shaped MIRA’s AI features, enabling real-time eligibility checks, smarter loan comparisons, and a centralized CRM.

AI-Driven Eligibility Analysis

Borrowers wanted instant feedback on mortgage eligibility. By automating checks with AI, MIRA provides real-time feedback, keeping users engaged.

AI-Smart Loan Comparisons

The research showed that borrowers often drop out when comparing loan options. MIRA’s detailed, AI-generated loan comparison helped users feel more confident in their decisions

Loan Officer Dashboard

Loan officers needed a more efficient way to manage leads. The introduction of MIRA’s centralized CRM system allowed them to track, assess, and convert leads seamlessly

THE RESULT

Smarter mortgage journeys with real-time AI insights

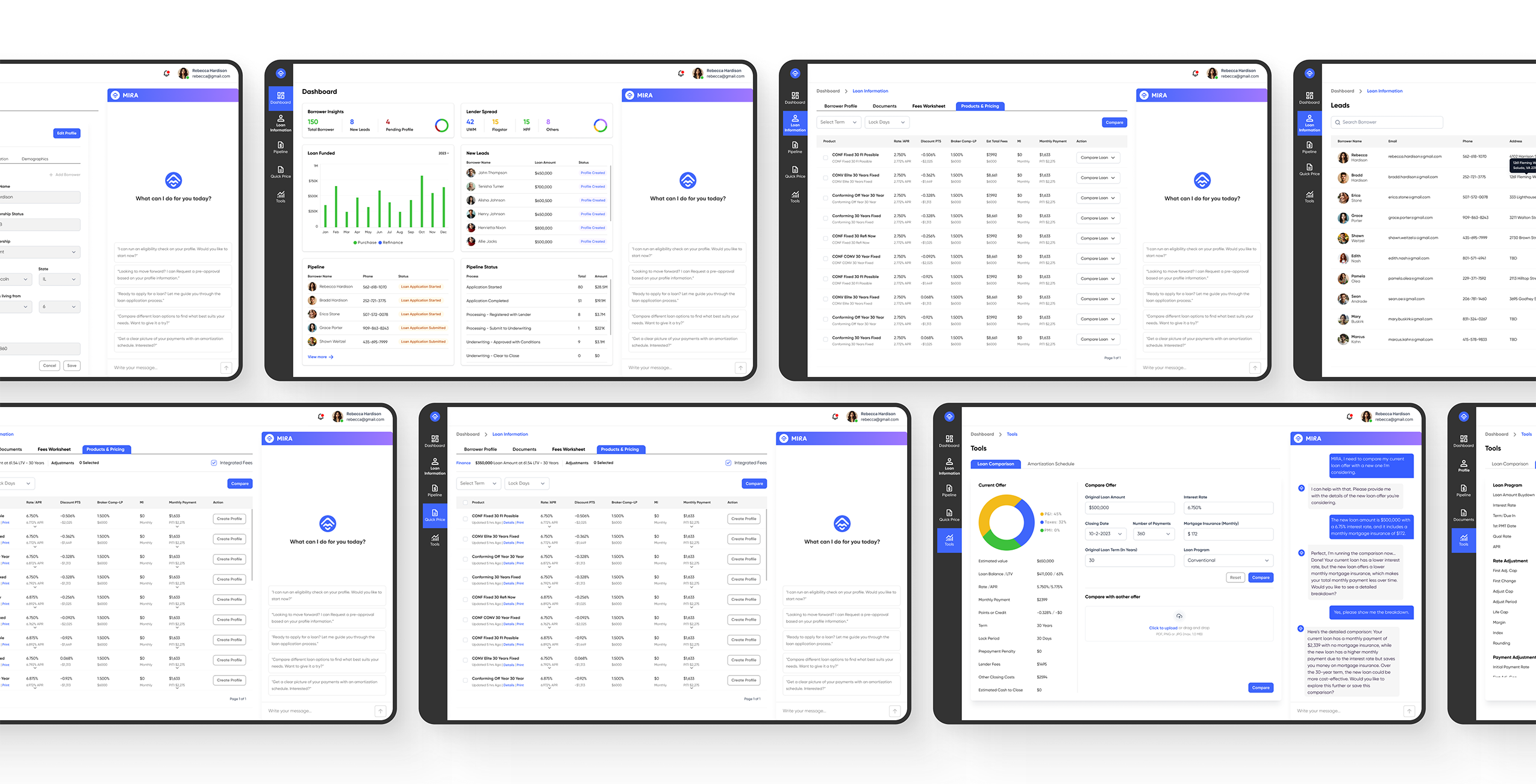

The MIRA AI platform successfully streamlined the mortgage process for both borrowers and loan officers. For borrowers, MIRA AI simplified profile creation, provided real-time eligibility analysis, and offered personalized loan comparisons, resulting in faster pre-approvals and improved decision-making. Loan officers benefited from automated lead management, reduced manual tasks, and real-time insights, enhancing their productivity and client satisfaction.

As a result, user engagement increased, approval times shortened. The platform’s AI-powered solutions addressed core pain points, making the mortgage journey more efficient, transparent, and user-friendly.

Harsh delivered a seamless, user-centered design that transformed a complex mortgage process into a simple and intuitive experience.